Get the free gratuity form

Show details

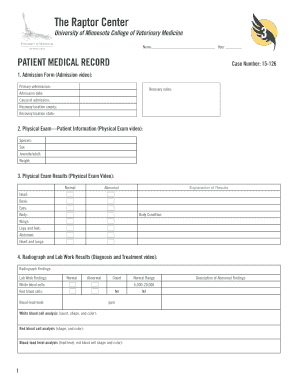

FORM 'L' See clause (i) of sub-rule (1) of rule 8 Notice for payment of gratuity To ???????????????????????????????????. Name and address of the applicant employee/nominee/1egal heir You are hereby

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form l

Edit your form l employer has to can i get gratuity certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is gratuity form l form l form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gratuity claim form online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gratuity application form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for gratuity by an employee form

How to fill out gratuity form l pdf:

01

Make sure you have a computer or device with software that can open and edit PDF files.

02

Download the gratuity form l PDF from the official website or the relevant authority.

03

Open the PDF file using the appropriate software.

04

Review the instructions and guidelines provided on the form to ensure you understand the requirements.

05

Fill in all the necessary personal information, such as your name, address, and contact details.

06

Provide the details of the employer for whom you are claiming gratuity, including their name and address.

07

Enter the length of your service with the employer in the appropriate section.

08

Calculate your gratuity entitlement, considering factors such as the number of years served and your salary.

09

Double-check all the information you have entered to ensure accuracy.

10

Sign and date the form to certify its authenticity.

11

Save a copy of the completed form for your records.

12

Submit the filled-out gratuity form l PDF to the relevant authority or employer as instructed.

Who needs gratuity form l pdf:

01

Employees who are eligible for gratuity benefits from their employers.

02

Individuals who have completed a minimum period of service with an employer, as specified by the relevant labor laws or employment contracts.

03

Workers who want to claim the lump-sum amount accruing to them upon leaving their job, retiring, or other qualifying events.

Fill

gratuity form l

: Try Risk Free

People Also Ask about gratuity form pdf download

How can I claim gratuity in Maharashtra?

The employee must apply and send the application for gratuity to the employer; Once the application is received, it is acknowledged and the amount of gratuity is calculated for further procedures; and. The employer pays the gratuity within a time frame of 30 days after disbursement of acknowledgement.

What is gratuity form L?

Form L, Employer has to issue notice to the applicant employee, nominee or legal heir specifying the amount of gratuity and the date of payment of gratuity in Form L. Note: The payment of gratuity is to be made within 30 days from the receipt of the application or the date from gratuity becomes payable.

How to fill gratuity form online?

On gratuity form I we have to write full name of employee and his complete address, department in which he has worked, employee number, date of appointment, date and reason for termination of service, total period of service, last drawn salary.

How to fill India gratuity form F?

On first page of gratuity nomination form F the detail like establishment details, employee name and nominee details have to be filled. On second page of gratuity nomination form F consists employee details, employee signature, witnesses signature and employer signature are required.

What is gratuity nomination form?

A nomination must be submitted by an employee within 30 days of the end of their first year of employment to be considered under the Payment of Gratuity Act, 1972. This would imply that the statute mandates that an employee must submit a nomination within 30 days after completing a year of service.

How can I get gratuity certificate?

The employee must apply and send the application for gratuity to the employer; Once the application is received, it is acknowledged and the amount of gratuity is calculated for further procedures; and. The employer pays the gratuity within a time frame of 30 days after disbursement of acknowledgement.

What is the form F?

Form F, Employee has to submit a nomination in duplicate to his employer and should get the copy of acknowledgment from employer. Note: It has to be submitted by an employee by personal service or through registered post, but in both the cases employee must take the acknowledgment from the employer.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in gratuity form i filled sample without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing form l gratuity and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out gratuity form l filled sample using my mobile device?

Use the pdfFiller mobile app to complete and sign gratuity form download on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I fill out how to fill out gratuity form l pdf 02 on an Android device?

Complete gratuity form pdf and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is gratuity form?

A gratuity form is a document used to formally request and record the payment of gratuity benefits, usually provided to employees upon termination of their service.

Who is required to file gratuity form?

Employers are required to file the gratuity form for employees who meet the eligibility criteria, typically based on their tenure and the company's gratuity policy.

How to fill out gratuity form?

To fill out a gratuity form, an employee generally needs to provide personal details, employment duration, reason for termination, and any other required information as specified by the employer.

What is the purpose of gratuity form?

The purpose of the gratuity form is to facilitate the process of claiming gratuity benefits and to ensure that the payment is accurately calculated and disbursed to eligible employees.

What information must be reported on gratuity form?

The information typically reported on a gratuity form includes the employee's name, employee ID, designation, date of joining, date of termination, total years of service, and the amount of gratuity payable.

Fill out your gratuity form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form I Payment Of Gratuity Act Pdf Download India is not the form you're looking for?Search for another form here.

Keywords relevant to gratuity letter

Related to gratuity form l filled sample pdf download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.